It’s been a busy year for compliance officers worldwide, and we’re only halfway through 2023. Changes—expected and unexpected—continued to impact global supply chains, leading many compliance officers to spend valuable time addressing not only new regulatory requirements and supply chain challenges (many of which are still an after-effect of the COVID-19 pandemic), but also new risks, including data privacy and cybersecurity threats.

So, what should compliance officers watch out—and prepare for—in the upcoming months?

This blog post will tackle 6 emerging compliance trends in 2023 and beyond.

AI: Friend or foe?

We cannot talk about emerging trends in 2023 without first tackling the elephant in the room: AI.

AI technology offers significant benefits to the field of compliance, including:

- Automated manual tasks

- Enhanced risk assessments

- Real-time monitoring and detection

- Improved compliance reporting

- Risk prediction and mitigation

- Scalability and adaptability

- Reduction of human error and bias

By leveraging AI in compliance, organisations can stay ahead of evolving regulatory requirements and ensure the integrity and trustworthiness of their operations.

Cybersecurity remains top of mind

“In a data-driven financial environment, cybercrime has emerged as a major concern for regulators and institutions, with criminals manipulating computer systems and online financial services to commit money laundering, fraud and other crimes.”

The European Institute of Management and Finance

2022 saw a 42% increase in cyberattacks, from the Distributed Denial of Service (DDoS) attack on the European Parliament website to ransomware attacks on AirAsia, Nvidia, Costa Rica’s banking operations, Uber, and more.

This number is only expected to rise in 2023, which makes cybersecurity a top priority for organisations worldwide.

There are a number of steps compliance officers can take to ensure a robust cybersecurity, including:

- Staying up-to-date with the latest cybersecurity threats, trends, and regulatory requirements. By staying informed, compliance officers can proactively address emerging cybersecurity risks and align compliance efforts with evolving best practices.

- Developing and implementing policies and procedures alongside IT and security teams. These documents should outline clear guidelines for employees on acceptable use of technology, data protection, password management, incident reporting, and other relevant areas.

- Conducting regular risk assessments, which help identify vulnerabilities, evaluate the potential impact of cyber threats, and prioritise risk mitigation efforts. By understanding the organisation’s specific risks and vulnerabilities, compliance officers can focus resources and initiatives on the most critical areas.

- Implementing access controls and data protection measures, such as strong authentication protocols, encryption for sensitive data, role-based access controls, and regular monitoring of user access privileges. By enforcing these measures, compliance officers can minimise the risk of unauthorised access and data breaches.

- Establishing incident response plans and procedures in collaboration with IT and security teams. These plans should outline the steps to be taken in the event of a cybersecurity incident, including containment, investigation, communication, and recovery.

Increased emphasis on data privacy

In today’s ever-changing business landscape, the increased focus on data privacy remains important for compliance officers, as they play a crucial role in ensuring that organisations adhere to legal and regulatory requirements—and data privacy regulations are a fundamental part of these obligations.

Protecting individual rights is a core aspect of data privacy regulations, making compliance officers directly responsible for safeguarding personal data from unauthorised access, misuse, and exploitation. By prioritising data privacy, you contribute to maintaining the trust between the organisation and its stakeholders.

Today, organisations often operate in various regions, each with its own set of data privacy requirements. Compliance officers need to understand the extraterritorial reach of regulations such as the GDPR, which can impact international data transfers. By establishing appropriate safeguards, you can ensure compliance with data privacy regulations regardless of the geographical location of operations.

Moreover, the regulatory landscape is constantly evolving. New laws are introduced, existing regulations are updated, and enforcement practices change. Compliance officers must stay informed about these regulatory developments and adapt their compliance strategies accordingly. By keeping up with changes in data privacy regulations, compliance officers can ensure that the organisation remains compliant, avoiding penalties and adapting to new requirements as they arise.

Regulatory Technology (RegTech) is on the rise

As the regulatory landscape becomes increasingly complex and dynamic—with new regulations being introduced and existing ones being updated regularly—compliance officers are tasked with understanding and implementing these regulations within their organisations.

RegTech solutions provide tools and technologies that help automate compliance processes, monitor regulatory changes, and ensure adherence to the latest requirements. By leveraging regtech, compliance officers can navigate the complexities of the regulatory environment more effectively and efficiently.

Other benefits include:

- Efficiency and time savings: Compliance officers are often burdened with manual and time-consuming tasks such as collecting, analysing, and interpreting regulatory data, preparing compliance reports, and managing compliance workflows. RegTech solutions automate these processes, reducing the reliance on manual efforts and streamlining compliance operations.

- Risk management and compliance monitoring: RegTech solutions offer advanced risk management tools that help compliance officers assess and monitor compliance risks more effectively. These solutions often incorporate real-time monitoring, data analytics, and reporting functionalities, enabling compliance officers to identify potential compliance breaches, track trends, and take proactive measures to address risks.

- Enhanced data management and reporting: RegTech solutions provide robust data management capabilities, including data aggregation, normalisation, and reporting functionalities—while also facilitating audit processes by providing easy access to audit trails, documentation, and evidence of compliance.

- Agility and adaptability: The regulatory landscape is constantly evolving, with new regulations, industry guidelines, and enforcement practices emerging. Compliance officers need to stay agile and adapt quickly to regulatory changes—and regtech solutions contain features (such as automated regulatory updates, regulatory intelligence, and regulatory mapping tools) that help compliance officers stay ahead of regulatory requirements, update compliance policies and procedures, and ensure ongoing compliance with evolving regulations.

All roads lead to Supply Chain Visibility (SCV)

The importance of Supply Chain Visibility (SCV) for the entire organisation cannot be overstated—and compliance officers play an active role in ensuring it.

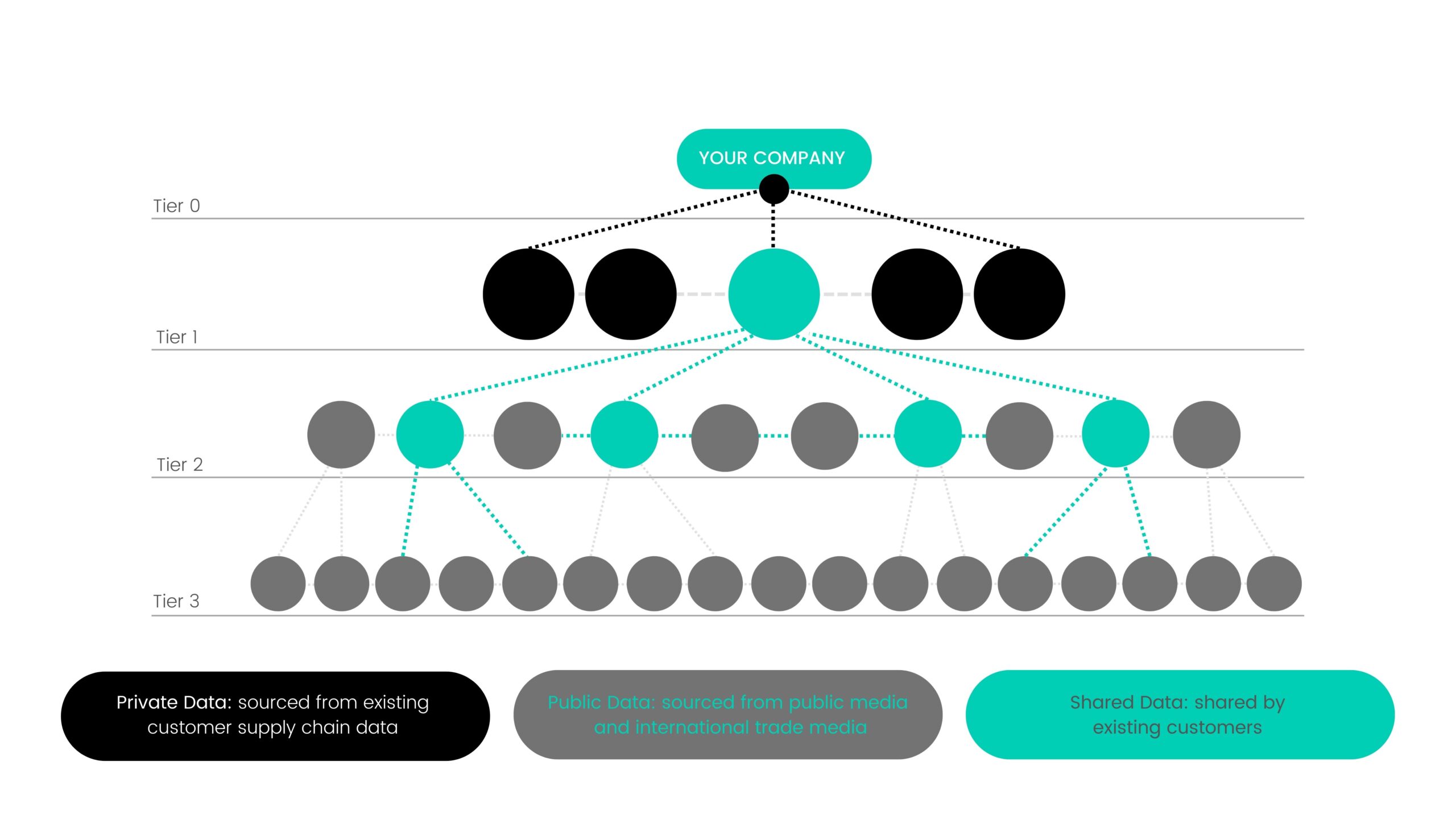

For many companies, however, SVC does not extend beyond their Tier 1 suppliers. This is because SCM departments are mostly focused on forming and maintaining strong relationships with their top-level suppliers, which ensures a certain amount of transparency. In other words, you are usually informed of any risks your Tier 1 suppliers might be exposing you to.

External risks, on the other hand, are typically unknown and can take any business by surprise. This is true for any supplier category—but more so for Tier-N.

These third-party suppliers branch out across multiple lower levels in the supply chain, which is a problem, considering how little is known about their risk exposures—especially when compared to the transparency of Tier 1 suppliers.

The solution?

Prewave’s Tier-N Monitoring, which is centred around complete supply chain visibility. The following graphic shows you how the solution works:

To recap:

- This comes at no extra cost to your suppliers

- Supply chain mapping will extend beyond your immediate suppliers

- You will receive alerts about events affecting the lower levels of your supply chain (Tier-N)

- You will be able to plan for and respond to any disruptions

Are you ready to begin the journey to supply chain resilience?

A continued emphasis on ESG initiatives

Environmental sustainability, social responsibility, and corporate governance are gaining significant attention from regulators, investors, and the public.

Compliance officers should stay informed about evolving ESG standards, reporting requirements, and disclosure guidelines to ensure their organisations meet the necessary compliance obligations.

The increased regulatory scrutiny on ESG factors is important, as it requires organisations to:

- Comply with ESG-related regulations

- Mitigate legal and reputational risks

- Address investor and stakeholder expectations

- Fulfil reporting and transparency requirements

- Integrate ESG considerations into business operations, and

- Navigate evolving ESG standards and frameworks

Compliance officers play a crucial role in establishing and maintaining robust ESG compliance programs, promoting responsible and sustainable practices, and safeguarding the organisation’s reputation and long-term viability.