In March 2024, The European Commission published a communication related to climate risk and its aim to become net zero by 2050. Titled “The European Green Deal”, this goal aims to reduce net greenhouse gas emissions over the next 26 years, cutting back by 55% by 2030 and to net zero by 2050.

In order to bring corporate entities toward this vision, the European Union has published several directives that ensure companies act in a way that meets sustainability and human rights goals. Two of these directives are the Corporate Sustainability Due Diligence Directive (CSDDD) and the Corporate Sustainability Reporting Directive (CSRD).

Although both directives pertain to sustainability, they have distinct scopes, reporting requirements, compliance obligations, and forecasted impacts. In this article, we’ll explore the difference between the CSDDD and the CSRD, outlining everything a business should understand for effective compliance.

What is the CSRD?

The Corporate Sustainability Reporting Directive is a compliance framework that ensures businesses report on the impact of their sustainability efforts and objectives. It is a part of environmental, social, and governance (ESG) policy that champions transparency and accountability for sustainable practices.

The CSRD came into force in January of 2023, outlining numerous rules and regulations that the EU and some non-EU companies will have to follow in regard to ESG disclosures. Companies will apply these rules in 2024 with the first reports launching in 2025. All companies that fall under the scope of this framework will have to follow the European Sustainability Reporting Standards (ESRS).

Scope

The CSRD ensures that large companies in the EU, and non-EU companies that work extensively in the EU, are transparent about how their company adheres to sustainability goals. It aims to give investors and general consumers full insight into how businesses manage and champion modern sustainability.

The scope expands upon the Non-Financial Reporting Directive (NFRD) to champion the transparency of sustainability impacts. The full scope of the CSRD will include around 50,000 EU companies, pushing them to clearly report on the environmental impact and sustainability goals. Previously, the NFRD covered around 11,000 companies

There are three general conditions that force companies to comply with the CSRD, with any listed organisation, bank, insurance company, and non-listed company that meets two of the following three having to comply:

- Possesses €25 million in total assets.

- Records €50 million in net turnover.

- Employs 250+ employees.

Alongside these criteria for EU companies, businesses outside the EU that record a net turnover of €150 inside the EU will have to comply.

Reporting Requirements of the CSRD

The CSRD requires that companies disclose all of their ESG impacts in annual management reports, separating out each aspect of environmental, social, and governance material considerations.

It’s important to note that the CSRD introduced the Double Materiality Assessment (DMA). The DMA is a mandatory requirement for businesses in which they must identify the sustainability objectives that are most important to the organisation and the stakeholders of that business.

The double materiality assessment ensures that businesses consider sustainability both in terms of the impact on people and the environment and how their actions could create new world risks. The first perspective (inside-out) would pertain to environmental destruction and human rights violations. The second (outside-in) would relate to how sustainability efforts impact a company’s financial longevity.

In order to deliver standardised reporting frameworks, the CSRD follows EU taxonomy. The classifications that companies use in other reports align with the CSRD expectations. Businesses already following the Task Force on Climate-related Financial Disclosures (TCFD) will be familiar with the expected style of report.

Compliance and Implementation

In April 2021, the initial text of the CSRD was considered by the European Council, with amendments being suggested. These initial suggestions were in relation to how the EU could expand upon the NFRD.

In June 2022, The European Council and Parliament reached a political agreement that approved the CSRD. In December of 2022, the legislation was passed and published in the Official Journal.

From January 2023, the CSRD came into force.

Impact

The European Council foresees the CSRD radically enhancing transparency and comparability in sustainability reporting frameworks. By expanding upon the scope of the NFRD, this directive will ensure companies consider how they actively work to mitigate climate risk and promote sustainable business practices both on an environmental and human level.

What is the CSDDD?

The Corporate Sustainability Due Diligence Directive aims to foster more sustainable practices and responsible behaviour in corporations in the EU. The CSDDD focuses equally on environmental considerations and human rights, pushing toward a healthy and sustainable corporate future.

This new set of rules will ensure that businesses inside Europe – and those outside the EU that have European value chains – promote the betterment of human rights protection, labour equality, improved risk management, and protection of the environment.

Scope

The scope of the CSDDD was a major point of contention during its drafting and proposal phases. Currently, the latest draft of the CSDDD (which is highly likely to be the final one) targets both EU-based and non-EU companies that operate in the European market.

Companies that meet one or several of the following criteria must comply with the CSDDD:

- EU and non-EU companies with 1,000 employees or more.

- EU companies that have a net turnover of €450,000,000

- Non-EU companies with €450 million in turnover in the EU.

There are additional bands that dictate when businesses will have to implement compliance initiatives, which we will discuss in the implementation section.

Key Requirements

If a company meets the above conditions, it must comply with the full extent of the CSDDD compliance regulations. These regulations aim to ensure that the company and all of its subsidiaries across its value chain identify and engage with environmental and human rights obligations.

Businesses must identify, prevent, and mitigate adverse impacts of their corporate enterprises, looking to reduce their impact where possible and align with leading practices.

The CSDDD also requires that businesses begin to look toward how they will align with the Paris Agreement Goals. With this considered, they must aim to achieve net-zero emissions by 2050 at the latest and help to limit global warming.

These requirements force companies to closely examine their current practices and determine whether or not they are working toward a sustainable future both socially and environmentally.

Compliance and Implementation

The CSDDD will first come into force in 2027, with companies expected to adopt and accommodate to its obligations by 2029 at the latest.

There are three distinct phases to CSDDD implementation, with each band depending on the size and turnover of an organisation:

- Phase 1, Implement by the end of 2027 – Companies with €1500 million+ in turnover and over 5000 employees.

- Phase 2, Implement by the end of 2028 – Companies with €900 million+ in turnover and over 3000 employees.

- Phase 3, Implement by the end of 2029 – Companies with €450 million+ in turnover over 1000 employees.

Businesses must also be aware that any parent company is responsible for all of their subsidiaries. The full scope of the CSDD will cover around 5,300 companies, which is much reduced from previous versions of this legislation.

Impact

The CSDDD will aim to encourage businesses both inside and outside of the EU to think critically about their value chains, identifying corporate behaviours and practices that do not align with the goal of a sustainable future. This insight will drive companies to mitigate harmful practices to both the environment and those that infringe on human rights.

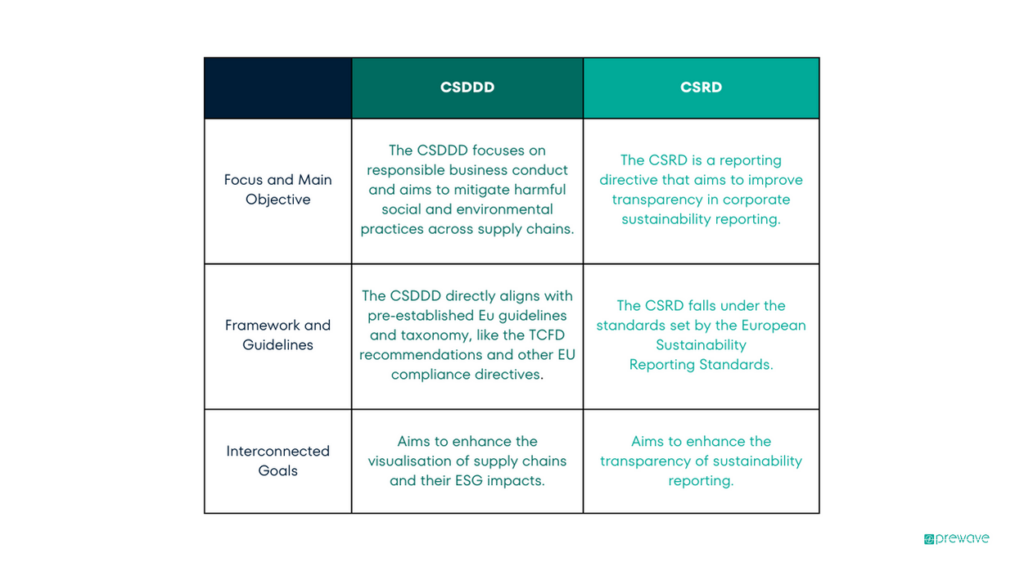

Comparative Analysis: Key Differences and Overlaps

While the CSDDD and the CSRD are distinct directives, they are complimentary, both pushing for higher levels of corporate responsibility in regard to ESG goals.

CSDDD Impact on Companies and Supply Chains

EU businesses and non-EU companies that have value chains in the EU will have to understand the scope of obligations that the CSDDD demands. Knowledge of corporate sustainability efforts and full insight into the partners a company uses in its supply chain will provide needed transparency to comply with the CSDDD.

Organisations should endeavour to establish due diligence frameworks to identify and address adverse impacts of their business operations. Especially with the range of potential risk monitoring and assessment tools available, companies cannot cite a lack of visibility into their own supply chain as an excuse.

Even businesses that do not yet cross the lowest compliance threshold (€450 million+ in turnover over 1000 employees) should aim to familiarise themselves with these standards. Reducing environmental challenges and human rights infringements across the supply chain should be a top priority.

For more information about the changing scope of the CSDDD and recommendations for effective compliance, we suggest you view the recent Prewave webinar on this directive.

Penalties for Non-Compliance

Businesses that fall into any of the bands which call for CSDDD compliance but fail to do so could experience penalties that significantly impact their revenues. While the majority of the penalty specifics are managed and enforced by each individual member state, typical fines will be at least 5% of net sales turnover.

Equally, organisations that fail to comply will experience compliance injunctions that may require further operational changes and increased reporting measures. Finally, non-EU companies that should comply and don’t may face exclusion from European markets, which could sever supply chain links in this major global market.

Practical Steps for Compliance

Compliance with the CSDDD obligations largely depends on effective preparation and full visibility over a company’s supply chain.

Businesses can move through the following steps to develop a compliance strategy:

- Publish Supplier Expectations – According to CSDDD obligations, publish clear documentation that details the standards of practice you expect from your suppliers. Reference that failure to compy with these standards could result in you taking your business elsewhere.

- Risk Assessment – Businesses can use risk assessment strategies to identify potential vulnerabilities in their supply chain. Certain suppliers may have known issues with human rights or environmental practices, with clarity about these problems allowing a business to find a replacement ahead of time.

- Risk Prioritisation – Determine which suppliers are high-risk and look into mitigative strategies that address these risks or move to diversify away from these suppliers.

- Supplier Auditing – Periodically audit your suppliers to ensure that the standards that align with CSDDD regulations are met.

- Improve Over Time – Regularly return to your risk assessments and reconduct auditing processes to find areas where you can improve. Rapid changes in social, political, or economic factors can lead suppliers to move away from compliance. Ongoing monitoring and improvement will help mitigate any surprises in your supply chain and help you to uphold CSDDD compliance.

Implementing strategies to align with CSDDD and CSRD directives as early as possible will give your business the time it needs to effectively audit, monitor, and replace any suppliers that cannot comply.

The more time you have to develop mitigative strategies and improve environmental and social policy compliance, the more prepared you will be for current and future regulatory frameworks.

Final Thoughts

Understanding both the CSDDD and the CSRD and what they signify for a business will help to contribute to sustainable business practices. Organisations should understand these directives in their entirety, as clarity about potential future obligations allows for proactive engagement, strategic planning, and compliance readiness.

For complete support in supply chain visibility and corporate compliance, reach out to Prewave. Organisations can turn to third-party solutions like Prewave for a comprehensive insight into potential risk, corporate sustainability directive obligations, and regulatory requirements.

Prewave helps businesses understand their compliance obligations and create effective practices to meet them!